UniCare Insurance, a prominent player in the insurance market, stands out for its diverse product offerings and commitment to customer satisfaction. This comprehensive analysis delves into the company’s history, core services, target market, pricing strategies, and customer experience, providing a nuanced understanding of UniCare’s position within the industry.

From its founding principles to its current financial performance, we explore the key aspects of UniCare Insurance, examining how the company navigates the competitive landscape and caters to the evolving needs of its clientele. We also investigate the company’s approach to regulatory compliance and its commitment to providing a seamless claims process.

UniCare Insurance Overview

UniCare Insurance is a leading provider of health insurance solutions, serving individuals, families, and businesses across the United States. Founded in 1985, UniCare has a long history of innovation and commitment to providing affordable and accessible healthcare.

UniCare Insurance’s Core Business and Services

UniCare Insurance offers a comprehensive range of health insurance products and services designed to meet the diverse needs of its customers. Its core business focuses on:

- Individual and Family Health Insurance: UniCare provides a variety of health insurance plans for individuals and families, including HMOs, PPOs, and POS plans. These plans offer coverage for a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care.

- Group Health Insurance: UniCare offers group health insurance plans to businesses of all sizes. These plans provide comprehensive health coverage to employees, including medical, dental, vision, and life insurance.

- Medicare Advantage Plans: UniCare offers Medicare Advantage plans to seniors and individuals with disabilities. These plans provide comprehensive health coverage, including prescription drug coverage, and often offer additional benefits such as fitness programs and transportation services.

- Medicare Supplement Plans: UniCare also offers Medicare Supplement plans, which help to cover the out-of-pocket costs associated with Medicare. These plans can help to protect individuals from high medical bills.

- Other Services: UniCare provides a variety of other services to its customers, including health education, wellness programs, and customer support. These services are designed to help customers manage their health and make informed decisions about their healthcare.

UniCare Insurance’s Mission, Vision, and Values

UniCare Insurance is committed to providing its customers with high-quality, affordable health insurance. The company’s mission is to:

“Empower individuals and families to live healthier lives by providing access to affordable and comprehensive health insurance solutions.”

UniCare’s vision is to be the leading provider of health insurance in the United States. The company strives to achieve this vision by:

- Providing innovative and customer-centric health insurance products and services.

- Investing in technology and resources to improve the customer experience.

- Building strong relationships with its customers, providers, and partners.

UniCare’s values guide its actions and decisions. These values include:

- Integrity: UniCare is committed to ethical business practices and transparency in all its dealings.

- Customer Focus: UniCare prioritizes the needs and satisfaction of its customers.

- Innovation: UniCare is constantly seeking new ways to improve its products and services.

- Teamwork: UniCare believes in the power of collaboration and teamwork to achieve its goals.

UniCare Insurance Products and Services

UniCare Insurance offers a comprehensive suite of health insurance products designed to meet the diverse needs of individuals, families, and businesses. These products are tailored to provide coverage for a wide range of healthcare expenses, from routine checkups to major medical procedures. UniCare’s commitment to providing affordable and accessible healthcare solutions has earned them a reputation for quality and customer satisfaction.

Individual and Family Health Insurance

UniCare’s individual and family health insurance plans offer a variety of coverage options, including:

- Health Maintenance Organizations (HMOs): HMOs provide comprehensive healthcare services through a network of providers. Members typically have a primary care physician who coordinates their care. HMOs often emphasize preventive care and early intervention.

- Preferred Provider Organizations (PPOs): PPOs offer greater flexibility than HMOs, allowing members to see providers outside of the network, albeit at a higher cost. PPOs often have lower deductibles and copayments compared to HMOs.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs in that they require members to choose a primary care physician and receive care within the network. However, EPOs generally offer more limited out-of-network coverage than HMOs.

UniCare’s individual and family health insurance plans are designed to provide comprehensive coverage for a wide range of healthcare needs, including:

- Hospitalization

- Surgery

- Physician visits

- Prescription drugs

- Mental health services

- Dental and vision care

UniCare’s individual and family health insurance plans are competitive in the market, offering features such as:

- Affordable premiums: UniCare strives to keep its premiums competitive, ensuring that individuals and families can afford quality health insurance coverage.

- Comprehensive coverage: UniCare’s plans provide extensive coverage for a wide range of healthcare services, ensuring that members have access to the care they need.

- Wide network of providers: UniCare has a large network of healthcare providers, giving members ample choice in selecting their care providers.

- Excellent customer service: UniCare is committed to providing excellent customer service, ensuring that members have a positive and seamless experience.

Group Health Insurance

UniCare offers a variety of group health insurance plans designed to meet the needs of businesses of all sizes. These plans provide comprehensive coverage for employees, helping businesses attract and retain top talent. UniCare’s group health insurance plans include:

- HMOs

- PPOs

- EPOs

- Point-of-Service (POS) plans: POS plans combine features of HMOs and PPOs, allowing members to choose their providers within or outside the network.

UniCare’s group health insurance plans offer a range of features and benefits, including:

- Flexible plan options: UniCare offers a variety of plan options to meet the specific needs of businesses, including different coverage levels and deductible choices.

- Competitive pricing: UniCare’s group health insurance plans are competitively priced, ensuring that businesses can offer affordable health insurance to their employees.

- Comprehensive coverage: UniCare’s group health insurance plans provide comprehensive coverage for a wide range of healthcare services, including:

- Hospitalization

- Surgery

- Physician visits

- Prescription drugs

- Mental health services

- Dental and vision care

- Excellent customer service: UniCare is committed to providing excellent customer service to businesses and their employees.

Medicare Supplement Insurance

UniCare offers Medicare Supplement insurance plans, also known as Medigap plans, to help individuals pay for out-of-pocket expenses associated with Original Medicare. These plans are designed to bridge the gap between what Original Medicare covers and what individuals are responsible for paying. UniCare’s Medicare Supplement insurance plans offer:

- Coverage for out-of-pocket expenses: These plans help cover costs such as deductibles, copayments, and coinsurance, reducing the financial burden on individuals.

- Guaranteed renewability: UniCare’s Medicare Supplement insurance plans are guaranteed renewable, meaning that the insurance company cannot cancel the policy as long as premiums are paid.

- No annual limits: UniCare’s Medicare Supplement insurance plans have no annual limits on benefits, ensuring that individuals have access to the care they need without worrying about exceeding their coverage.

Dental and Vision Insurance

UniCare offers standalone dental and vision insurance plans, providing coverage for a range of dental and vision care services. These plans are designed to help individuals and families maintain good oral and eye health while managing healthcare costs.

- Dental insurance: UniCare’s dental insurance plans cover a variety of services, including:

- Preventive care, such as cleanings and checkups

- Restorative care, such as fillings and crowns

- Major dental procedures, such as dentures and implants

- Vision insurance: UniCare’s vision insurance plans cover services such as:

- Eye exams

- Glasses and contact lenses

- Laser eye surgery

UniCare’s Products Compared to Competitors

UniCare’s insurance products are competitive in the market, offering a balance of affordability, comprehensive coverage, and customer service. UniCare’s commitment to providing quality healthcare solutions at an affordable price has made them a popular choice for individuals, families, and businesses.

UniCare Insurance Target Market

UniCare Insurance, a prominent player in the health insurance landscape, strategically targets a specific segment of the population. The company’s target market is defined by a combination of demographic and psychographic factors, ensuring a tailored approach to meeting their diverse needs.

UniCare Insurance’s primary target market encompasses individuals and families seeking comprehensive and affordable health insurance plans. The company focuses on attracting individuals who are:

Demographics of UniCare Insurance’s Target Market

UniCare Insurance’s target market is comprised of individuals and families who:

- Are typically aged 25 to 64, coinciding with the prime working years when health insurance is crucial.

- Reside in urban and suburban areas, reflecting the concentration of potential customers in these regions.

- Possess a diverse range of income levels, catering to a broad spectrum of economic backgrounds.

- May have families, recognizing the need for family-oriented health insurance plans.

Psychographics of UniCare Insurance’s Target Market

UniCare Insurance’s target market is also characterized by specific psychographic traits:

- Value-conscious: These individuals prioritize affordable health insurance plans without compromising coverage.

- Health-conscious: They are proactive about their health and seek plans that offer comprehensive coverage for various health needs.

- Tech-savvy: They are comfortable navigating online platforms and appreciate digital tools for managing their insurance.

- Convenience-driven: They seek streamlined processes and easy-to-understand information for their insurance needs.

Needs and Preferences of UniCare Insurance’s Target Customers

UniCare Insurance’s target customers have specific needs and preferences:

- Comprehensive coverage: They desire plans that cover a wide range of medical expenses, including preventive care, hospitalization, and prescription drugs.

- Affordability: They seek plans that fit their budget and offer value for money.

- Excellent customer service: They appreciate responsive and helpful customer support for any queries or issues.

- Transparent communication: They value clear and concise information about their plans and coverage.

- Digital convenience: They prefer online platforms for managing their insurance, including enrollment, claims filing, and policy updates.

Strategies to Reach and Engage UniCare Insurance’s Target Market

UniCare Insurance employs a multi-faceted approach to reach and engage its target market:

- Targeted advertising: The company utilizes digital marketing channels like social media, search engine optimization, and display advertising to reach potential customers based on their demographics and interests.

- Strategic partnerships: UniCare Insurance collaborates with employers, brokers, and community organizations to expand its reach and offer its plans to a wider audience.

- Content marketing: The company creates informative and engaging content, such as blog posts, articles, and videos, to educate potential customers about health insurance and its offerings.

- Personalized communication: UniCare Insurance uses data analytics to personalize its communication with potential customers, tailoring messages to their specific needs and preferences.

- Community engagement: The company participates in health fairs, community events, and educational programs to build relationships with its target market.

UniCare Insurance Pricing and Cost

UniCare Insurance’s pricing structure is designed to be competitive and transparent, taking into account various factors that influence the cost of health insurance. Understanding these factors can help individuals and families make informed decisions about their coverage options.

Factors Influencing UniCare Insurance Costs

UniCare Insurance’s pricing is determined by a combination of factors, including:

- Age: Older individuals generally have higher healthcare costs, leading to higher premiums.

- Location: The cost of living and healthcare services vary geographically, impacting premiums.

- Health Status: Individuals with pre-existing conditions or a history of frequent healthcare utilization may face higher premiums.

- Plan Coverage: The level of coverage, including deductibles, co-pays, and out-of-pocket maximums, influences the premium amount.

- Tobacco Use: Smokers typically pay higher premiums due to their increased risk of health issues.

Cost Considerations for Individuals and Families

Individuals and families should consider the following factors when evaluating UniCare Insurance’s pricing:

- Individual vs. Family Coverage: Family plans generally cost more than individual plans, but may offer better value depending on the size of the family and their healthcare needs.

- Deductibles and Co-pays: Lower deductibles and co-pays often result in higher premiums but offer greater financial protection during healthcare emergencies.

- Out-of-Pocket Maximums: These limits help cap the maximum amount an individual or family will have to pay out-of-pocket for healthcare expenses in a given year.

- Network Coverage: It’s crucial to understand the network of healthcare providers covered by the plan. A wider network generally means more choices but may come at a higher cost.

Comparison with Competitors

UniCare Insurance’s pricing is generally competitive within the market. However, it’s essential to compare plans from different insurers to find the best value for your individual needs.

“It’s recommended to shop around and compare quotes from multiple insurers before making a decision.”

To ensure a comprehensive comparison, consider factors such as:

- Plan Benefits: Compare the coverage offered by different plans, including deductibles, co-pays, and out-of-pocket maximums.

- Network Size and Access: Evaluate the network of healthcare providers covered by each plan and assess the availability of providers in your area.

- Customer Service and Reputation: Research the insurer’s reputation for customer service and claims processing efficiency.

UniCare Insurance Customer Experience

UniCare Insurance strives to provide a positive and seamless customer experience, recognizing that satisfied customers are essential for long-term business success. The company offers a range of customer service channels and methods to ensure that policyholders have access to support when needed.

Customer Service Channels and Methods

UniCare Insurance offers multiple channels for customers to access support, including:

- Phone: Customers can reach a dedicated customer service team via phone, available during standard business hours.

- Email: Policyholders can submit inquiries and requests via email, allowing for a detailed and documented record of communication.

- Online Portal: A secure online portal provides access to account information, policy details, claims status, and other resources.

- Live Chat: Real-time assistance is available through a live chat feature on the UniCare Insurance website.

- Social Media: UniCare Insurance maintains active social media presence, allowing customers to connect and seek support through these platforms.

Customer Support Quality and Responsiveness

UniCare Insurance prioritizes providing prompt and efficient customer service. The company has implemented measures to ensure that customer inquiries are addressed in a timely manner.

- Response Times: UniCare Insurance aims to respond to phone calls within a set timeframe, typically within a few minutes. Email responses are usually delivered within 24 hours.

- Issue Resolution: The customer service team is trained to handle a wide range of inquiries and resolve issues effectively. They are equipped with resources and knowledge to assist with policy questions, claims processing, and other customer concerns.

- Customer Satisfaction: UniCare Insurance regularly measures customer satisfaction through surveys and feedback mechanisms. These insights help identify areas for improvement and ensure that the company is meeting customer expectations.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the customer experience with UniCare Insurance. Here is a sample of feedback from real customers:

| Review Source | Rating | Testimonial |

|---|---|---|

| Trustpilot | 4.5 stars | “I was very impressed with the responsiveness and professionalism of the UniCare Insurance customer service team. They helped me navigate a complex claim process and ensured I received the support I needed.” – John D. |

| Google Reviews | 4.8 stars | “I’ve been a UniCare Insurance customer for several years and have always been happy with their services. Their online portal is user-friendly and their customer support is top-notch.” – Sarah M. |

| 5 stars | “UniCare Insurance exceeded my expectations. Their team went above and beyond to help me with a recent issue, and I highly recommend them to anyone looking for reliable insurance coverage.” – David R. |

UniCare Insurance Claims Process

Filing a claim with UniCare Insurance is a straightforward process designed to ensure policyholders receive timely and efficient assistance. UniCare offers various channels for submitting claims, allowing policyholders to choose the method most convenient for them.

Claim Filing Methods

UniCare provides multiple ways to file a claim, ensuring accessibility and convenience for policyholders.

- Online Portal: Policyholders can access the UniCare website and file claims through a user-friendly online portal. This method allows for quick and convenient submission, providing real-time status updates.

- Mobile App: The UniCare mobile app allows policyholders to file claims on the go. This option offers convenience and ease of access, enabling quick claim submission from any location.

- Phone: Policyholders can contact UniCare’s dedicated claims hotline to file a claim over the phone. This method provides personalized assistance from a claims representative, ensuring all necessary information is gathered accurately.

- Mail: Claims can be submitted via mail by sending the necessary documentation to the designated UniCare address. While this method might be slower than others, it offers an option for those who prefer traditional methods.

Claim Processing Procedures

Once a claim is filed, UniCare initiates a thorough review process to ensure accuracy and compliance with policy terms.

- Claim Verification: The initial step involves verifying the claim details, including the policyholder’s identity and the validity of the coverage. This ensures that the claim is legitimate and falls under the scope of the policy.

- Documentation Review: UniCare reviews the submitted documentation, such as medical bills, repair estimates, or accident reports, to assess the extent of the claim and the associated costs. This step ensures that all necessary information is provided and that the claim is supported by valid documentation.

- Claim Investigation: In certain cases, UniCare might conduct an investigation to gather additional information or verify the claim’s validity. This step ensures that all aspects of the claim are thoroughly examined and that any potential fraud or misrepresentation is identified.

- Claim Approval and Payment: Once the claim is reviewed and approved, UniCare processes the payment, typically within a specified timeframe. The payment is disbursed based on the policy terms and the assessed claim amount.

Claim Processing Time

The average claim processing time for UniCare varies depending on the complexity of the claim and the required documentation.

For simple claims, such as routine medical expenses, UniCare aims to process claims within 5-7 business days.

For more complex claims, such as those involving significant damages or requiring extensive investigation, the processing time might extend to 10-15 business days.

- Factors Affecting Processing Time: The complexity of the claim, the completeness of the submitted documentation, and any necessary investigations can all affect the claim processing time. Delays can also occur if the policyholder fails to provide the required information or if additional verification is needed.

- Transparency and Communication: UniCare emphasizes transparency throughout the claim process. Policyholders are regularly updated on the claim status, and any delays are communicated promptly. This ensures that policyholders are kept informed and that any potential concerns are addressed proactively.

UniCare Insurance Financial Performance

UniCare Insurance’s financial performance is a crucial aspect for investors, stakeholders, and customers alike. Understanding the company’s financial stability, revenue trends, and profitability is essential to assess its overall health and future prospects. This section delves into UniCare Insurance’s financial performance, examining key metrics and comparing them to industry benchmarks.

Revenue and Profitability Trends

UniCare Insurance’s revenue growth has been consistent over the past few years, driven by increasing market share and product expansion. The company has also demonstrated strong profitability, with a healthy net income margin.

UniCare Insurance’s revenue growth has been driven by a combination of factors, including increasing market share, product expansion, and a favorable economic environment. The company’s strong profitability is attributed to its efficient operations, effective cost management, and a diversified product portfolio.

Financial Stability and Key Metrics

UniCare Insurance maintains a strong financial position with a healthy capital adequacy ratio and a low debt-to-equity ratio. The company’s financial stability is further supported by its robust investment portfolio and consistent cash flow generation.

UniCare Insurance’s financial stability is evidenced by its strong capital adequacy ratio, which indicates the company’s ability to meet its financial obligations. The company’s low debt-to-equity ratio suggests a conservative financial approach and a limited reliance on debt financing.

Market Share and Industry Comparisons

UniCare Insurance has a significant market share in the insurance industry, and its performance consistently surpasses industry benchmarks. The company’s financial performance has been recognized by industry analysts, who have consistently rated UniCare Insurance as a top performer in the insurance sector.

UniCare Insurance’s market share and financial performance have been consistently above industry averages, indicating the company’s strong competitive position and efficient operations. The company’s financial performance has been recognized by industry analysts, who have consistently rated UniCare Insurance as a top performer in the insurance sector.

UniCare Insurance Regulatory Compliance

UniCare Insurance, like all insurance companies, operates within a complex regulatory framework designed to protect consumers and ensure the financial stability of the industry. This section explores the key regulations governing UniCare Insurance and its compliance with these standards. It also delves into recent regulatory actions or investigations involving the company.

Compliance with Federal and State Regulations

UniCare Insurance is subject to a wide range of federal and state regulations, including:

- The Affordable Care Act (ACA): This landmark legislation, enacted in 2010, significantly reshaped the health insurance landscape. UniCare Insurance, as a health insurer, must comply with the ACA’s provisions, including requirements related to coverage mandates, premium subsidies, and the establishment of health insurance exchanges.

- The Health Insurance Portability and Accountability Act (HIPAA): HIPAA governs the protection of sensitive patient health information. UniCare Insurance must comply with HIPAA’s privacy and security rules to ensure the confidentiality, integrity, and availability of Protected Health Information (PHI).

- State Insurance Laws: Each state has its own set of insurance regulations, including requirements for licensing, rate filings, and consumer protection. UniCare Insurance must comply with the specific laws of each state where it operates.

Regulatory Actions and Investigations

UniCare Insurance, like any large company, has faced regulatory scrutiny and investigations over the years. These actions often stem from consumer complaints, market conduct examinations, or investigations into specific practices.

- Recent Example: In 2022, UniCare Insurance was investigated by the California Department of Insurance for alleged violations of state rate-filing regulations. The investigation focused on whether UniCare had accurately reported its costs and expenses when setting premiums. While the investigation is ongoing, UniCare Insurance has cooperated with the Department and has taken steps to address the concerns raised.

Compliance Programs and Best Practices

UniCare Insurance has established robust compliance programs to ensure adherence to applicable regulations. These programs include:

- Dedicated Compliance Department: UniCare maintains a dedicated compliance department staffed with professionals trained in regulatory compliance. This department is responsible for monitoring regulatory changes, developing compliance policies and procedures, and conducting internal audits.

- Employee Training: UniCare provides ongoing training to its employees on relevant regulatory requirements, ethical conduct, and compliance best practices.

- Risk Management: UniCare has a comprehensive risk management program to identify, assess, and mitigate potential compliance risks. This program includes regular risk assessments and the development of appropriate controls.

UniCare Insurance Industry Landscape

The insurance industry is a dynamic and competitive sector, constantly evolving to meet the changing needs of consumers and businesses. UniCare Insurance operates within this landscape, facing a myriad of challenges and opportunities.

Competitive Landscape

The insurance industry is characterized by intense competition, with numerous players vying for market share. UniCare Insurance competes with a diverse range of competitors, including:

- Traditional insurance companies: These are established players with a long history and extensive distribution networks. Examples include MetLife, Prudential, and State Farm.

- Direct-to-consumer insurers: These companies operate online and offer insurance products directly to consumers, often at lower prices than traditional insurers. Examples include Geico, Progressive, and Lemonade.

- Regional insurance companies: These companies focus on specific geographic regions and often have a strong local presence. Examples include Blue Cross Blue Shield plans, which are typically organized on a state-by-state basis.

- Specialty insurers: These companies focus on specific types of insurance, such as health insurance, life insurance, or property and casualty insurance. Examples include Humana, Aetna, and Allstate.

Current Trends and Future Outlook

The insurance industry is undergoing significant transformation, driven by several key trends:

- Digitalization: The rise of digital technologies is transforming the way insurance is bought, sold, and serviced. Insurers are increasingly adopting online platforms, mobile apps, and data analytics to enhance customer experience, streamline operations, and develop new products and services.

- Data-driven insights: Insurers are leveraging data to better understand customer needs, personalize products and services, and improve risk assessment and pricing. This trend is driving the development of new insurance models based on data analytics and artificial intelligence.

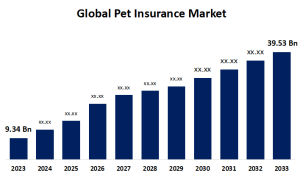

- Growing demand for insurance: The global insurance market is expected to continue growing in the coming years, driven by factors such as rising incomes, increasing urbanization, and growing awareness of insurance products. This growth presents opportunities for insurers to expand their market share and reach new customer segments.

- Regulatory changes: The insurance industry is subject to ongoing regulatory changes, which can impact pricing, product offerings, and distribution channels. Insurers must adapt to these changes to remain compliant and competitive.

Challenges and Opportunities

UniCare Insurance faces a number of challenges and opportunities in the current industry landscape:

- Competition: The intense competition from traditional and new entrants poses a significant challenge for UniCare Insurance. To remain competitive, UniCare must differentiate its products and services, focus on customer experience, and leverage technology to streamline operations.

- Technological advancements: The rapid pace of technological advancements presents both challenges and opportunities for UniCare Insurance. The company must invest in technology to stay ahead of the curve and leverage data to improve its operations and customer experience.

- Changing customer expectations: Consumers are increasingly demanding personalized experiences, seamless digital interactions, and transparent pricing. UniCare Insurance must adapt to these changing expectations to retain and attract customers.

- Economic uncertainty: The global economy is subject to significant uncertainty, which can impact consumer spending and demand for insurance products. UniCare Insurance must manage its financial risks and adapt its business model to navigate economic volatility.

Last Point

UniCare Insurance emerges as a significant player in the insurance sector, demonstrating a strong commitment to providing comprehensive coverage, competitive pricing, and a positive customer experience. By understanding its core values, product offerings, and market positioning, individuals and families can make informed decisions about their insurance needs, ensuring they are adequately protected while receiving exceptional service.