Casualty Insurance – The traditional insurance landscape is undergoing a seismic shift, driven by technological advancements and evolving customer demands. At the heart of this transformation lies universal property & casualty insurance, a revolutionary approach that promises greater flexibility, personalization, and cost-effectiveness. Unlike conventional insurance models, universal property & casualty insurance offers a dynamic framework that adapts to the unique needs of individuals and businesses, providing comprehensive protection against a wide range of risks.

This innovative insurance model empowers policyholders with unparalleled control over their coverage, allowing them to customize their policies to precisely align with their specific risk profiles and financial circumstances. From homeowners seeking peace of mind to businesses navigating complex liability exposures, universal property & casualty insurance offers a tailored solution that addresses the diverse needs of today’s risk-averse world.

Universal Property & Casualty Insurance

Definition and Scope

Universal property and casualty insurance is a relatively new concept in the insurance industry that seeks to offer a comprehensive and flexible approach to risk protection. Unlike traditional insurance policies, which typically focus on specific types of risks, universal insurance aims to provide a single policy that covers a wide range of potential losses, encompassing both property and liability exposures.

This approach offers numerous advantages, including simplified administration, reduced paperwork, and greater flexibility for policyholders.

Key Features

Universal property and casualty insurance is distinguished from traditional insurance by several key features:

- Comprehensive Coverage: These policies are designed to cover a broad range of potential risks, including property damage, personal liability, and even business interruption. This eliminates the need for multiple policies, streamlining risk management and reducing administrative burden.

- Customization: Policyholders can tailor their coverage to meet their specific needs by selecting the desired levels of protection for different types of risks. This flexibility allows individuals and businesses to optimize their insurance coverage based on their unique circumstances.

- Modular Structure: Universal insurance policies often employ a modular structure, allowing policyholders to choose specific coverage modules that align with their risk profile. This modularity provides greater control over the policy’s scope and cost.

- Technology-Driven: Universal insurance leverages technology to enhance efficiency, transparency, and customer experience. Online platforms and mobile apps facilitate policy management, claims reporting, and communication with insurers.

Types of Risks Covered

Universal property and casualty insurance policies typically cover a wide range of risks, including:

- Property Damage: This includes coverage for damage to buildings, structures, and personal belongings caused by various perils, such as fire, theft, vandalism, and natural disasters.

- Personal Liability: Protection against legal claims arising from accidents or injuries that occur on the insured’s property or as a result of their actions. This coverage extends to personal injury, property damage, and defamation.

- Business Interruption: Coverage for lost income and expenses incurred when a business is forced to shut down due to an insured event. This can include coverage for lost profits, salaries, and rent.

- Cybersecurity: Protection against financial losses and data breaches resulting from cyberattacks. This coverage may include expenses related to data recovery, legal defense, and notification of affected individuals.

Benefits and Advantages

Universal property and casualty insurance offers a comprehensive approach to risk management, providing numerous benefits for individuals and businesses. This type of insurance safeguards against financial losses arising from unforeseen events, offering peace of mind and financial stability.

Simplified Insurance Management

Universal property and casualty insurance streamlines the process of managing insurance coverage by consolidating multiple policies into a single package. This approach simplifies policy administration, reducing the need for separate premiums and renewal dates for different types of coverage. Individuals and businesses can enjoy the convenience of managing their insurance needs through a single provider, simplifying communication and claims processing.

Coverage Options and Customization

Universal property and casualty insurance offers a wide range of coverage options, allowing policyholders to tailor their insurance to their specific needs and risk profiles. This customization ensures that individuals and businesses are adequately protected against potential financial losses while avoiding unnecessary expenses.

Coverage Options

The specific coverage options offered by universal property and casualty insurance policies vary depending on the insurer and the policyholder’s needs. However, common coverage options include:

- Property Coverage: This protects against damage or loss to the insured property, such as a home, business, or vehicle, due to various perils like fire, theft, vandalism, or natural disasters.

- Liability Coverage: This provides financial protection against legal claims arising from injuries or property damage caused by the insured. This can include personal liability coverage for individuals or general liability coverage for businesses.

- Personal Injury Coverage: This coverage extends protection against claims for personal injuries, such as slander, libel, or wrongful eviction, regardless of whether the insured was at fault.

- Medical Payments Coverage: This provides coverage for medical expenses incurred by the insured or others involved in an accident, regardless of fault. This is often included in auto insurance policies.

- Uninsured/Underinsured Motorist Coverage: This protects the insured in case of an accident with a driver who is uninsured or underinsured. It helps cover medical expenses, lost wages, and property damage.

- Collision Coverage: This covers damage to the insured vehicle resulting from a collision with another vehicle or object, regardless of fault. This is typically included in auto insurance policies.

- Comprehensive Coverage: This protects the insured vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. This is also typically included in auto insurance policies.

- Flood Insurance: This provides coverage for damage caused by flooding, which is often excluded from standard property insurance policies.

- Earthquake Insurance: This protects against damage caused by earthquakes, which are typically excluded from standard property insurance policies.

Customization Options

Policyholders can further customize their universal property and casualty insurance policies by choosing specific coverage options and adjusting coverage limits and deductibles. These options allow individuals to tailor their insurance to their unique circumstances and risk tolerance.

Deductibles

Deductibles are the out-of-pocket expenses policyholders must pay before their insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. Policyholders can choose a deductible that aligns with their financial situation and risk tolerance.

For example, a policyholder with a lower risk tolerance and a larger emergency fund might choose a lower deductible, while someone with a higher risk tolerance and a smaller emergency fund might opt for a higher deductible to reduce their premiums.

Coverage Limits

Coverage limits determine the maximum amount the insurer will pay for a covered loss. Policyholders can adjust coverage limits based on the value of their property or the potential financial risks they face.

For instance, a homeowner with a valuable property might choose higher coverage limits for their dwelling and personal belongings, while someone with a less valuable property might choose lower coverage limits.

Coverage Exclusions

While universal property and casualty insurance offers comprehensive coverage, there are often certain events or circumstances excluded from coverage. Policyholders should carefully review their policy documents to understand these exclusions and consider additional coverage options if necessary.

Common exclusions include acts of war, intentional acts, and damage caused by wear and tear.

Pricing and Cost Factors

The cost of universal property and casualty insurance is influenced by a variety of factors, including the type of coverage, the location of the property, the value of the property, and the risk profile of the insured. Understanding these factors can help you make informed decisions about your insurance coverage and potentially reduce your premiums.

Premium Calculation

Insurance premiums are calculated based on a complex formula that takes into account various risk factors.

- Coverage Type: Different types of coverage, such as homeowners insurance, renters insurance, or commercial property insurance, have different premiums based on the risks associated with each type.

- Location: The location of the property is a significant factor in determining premiums. Properties in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, generally have higher premiums.

- Value of Property: The value of the property being insured directly impacts the premium. Higher-value properties require more coverage and therefore have higher premiums.

- Risk Profile: The insured’s risk profile is another important factor. This includes factors such as credit score, claims history, and safety measures taken to mitigate risk. Individuals with a good credit score and a clean claims history typically receive lower premiums.

Factors Affecting Premiums

- Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, as you are taking on more financial responsibility in case of a claim.

- Coverage Limits: Coverage limits define the maximum amount your insurance policy will pay for a covered loss. Higher coverage limits typically lead to higher premiums.

- Safety Measures: Implementing safety measures, such as installing smoke detectors, burglar alarms, or security systems, can reduce your risk profile and potentially lower your premiums. Insurance companies often offer discounts for these safety measures.

- Claims History: Your claims history is a significant factor in determining your premium. Frequent claims can lead to higher premiums, as it indicates a higher risk of future claims.

- Discounts: Insurance companies offer various discounts to incentivize good behavior and reduce risk. Some common discounts include multi-policy discounts, safe driving discounts, and bundling discounts for combining multiple insurance policies.

Tips for Reducing Insurance Costs

- Shop Around: Compare quotes from multiple insurance companies to find the best rates and coverage options.

- Increase Your Deductible: Consider increasing your deductible to lower your premium. However, ensure you can afford the higher out-of-pocket expense in case of a claim.

- Implement Safety Measures: Install safety features in your home or business, such as smoke detectors, burglar alarms, and security systems, to reduce your risk profile and potentially lower your premiums.

- Maintain a Good Credit Score: A good credit score can lead to lower insurance premiums, as it indicates financial responsibility and a lower risk of claims.

- Bundle Your Policies: Combining multiple insurance policies, such as homeowners and auto insurance, with the same company can often result in discounts.

- Negotiate Your Premium: Don’t hesitate to negotiate with your insurance company to see if you can secure a lower premium, especially if you have a good claims history and have implemented safety measures.

Claims Process and Customer Support

Navigating a property and casualty insurance claim can be a complex and stressful experience. Universal insurance companies prioritize a smooth and efficient claims process to minimize the burden on policyholders during challenging times. This section will detail the steps involved in filing a claim, the processing methods used, and the comprehensive customer support offered by universal insurance providers.

Filing a Claim

Policyholders can file a claim with universal insurance companies through various methods, offering flexibility and convenience. The most common methods include:

- Online Portal: Many universal insurers provide secure online platforms where policyholders can submit claims electronically, often accompanied by supporting documentation like photos or videos. This method allows for 24/7 accessibility and quick processing.

- Phone Call: Policyholders can contact the insurer’s dedicated claims line, where trained representatives are available to guide them through the process and gather necessary information.

- Mobile App: Several universal insurers offer mobile apps that streamline the claims process, enabling policyholders to file claims, track their progress, and communicate with customer support directly from their mobile devices.

Claim Processing

Once a claim is filed, universal insurance companies employ a systematic process to ensure fairness and efficiency:

- Initial Assessment: The insurer reviews the claim details, including the nature of the incident, date of occurrence, and policy coverage.

- Investigation: To verify the claim, the insurer may conduct an investigation, which can involve contacting witnesses, reviewing documentation, or conducting a site inspection.

- Damage Assessment: For property damage claims, the insurer will typically engage a qualified appraiser or adjuster to assess the extent of the damage and determine the cost of repairs or replacement.

- Claim Approval: Based on the investigation and damage assessment, the insurer makes a decision on whether to approve the claim. If approved, the insurer will determine the amount of compensation payable.

- Payment and Settlement: Once the claim is approved, the insurer will issue payment to the policyholder, either directly or through a designated repair contractor. The payment may be made in a lump sum or in installments, depending on the specific claim and policy terms.

Customer Support

Universal insurance companies prioritize exceptional customer support throughout the claims process. This commitment includes:

- 24/7 Accessibility: Policyholders can access customer support through various channels, including phone, email, and online chat, ensuring assistance is available whenever needed.

- Dedicated Claims Representatives: Experienced claims representatives are available to guide policyholders through the entire process, answer questions, and address concerns.

- Personalized Support: Universal insurers strive to provide personalized support, tailoring their assistance to the individual needs and circumstances of each policyholder.

- Transparent Communication: Insurers keep policyholders informed about the progress of their claims, providing regular updates and clear explanations of each step involved.

- Dispute Resolution: If a policyholder disagrees with the insurer’s decision, a formal dispute resolution process is available, ensuring fairness and transparency in addressing any disagreements.

Comparison with Traditional Insurance

Universal property and casualty insurance, also known as “UPC insurance,” is a relatively new type of insurance that offers a more flexible and customizable approach to coverage compared to traditional insurance. This article explores the key differences between UPC insurance and traditional insurance, highlighting the advantages and disadvantages of each approach.

Coverage and Benefits

Traditional insurance policies typically offer a standardized set of coverages, while UPC insurance provides a broader range of options, allowing policyholders to tailor their coverage to their specific needs.

For example, traditional homeowners insurance policies typically cover damage from fire, wind, and hail, but may not include coverage for earthquakes or floods. UPC insurance policies can be customized to include these additional coverages, providing greater peace of mind for homeowners in areas prone to these risks.

UPC insurance policies also often offer a wider range of benefits than traditional policies. These benefits may include:

- Higher coverage limits

- Lower deductibles

- Access to specialized services, such as risk management consulting

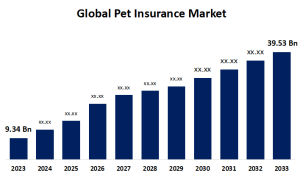

Pricing and Cost Factors

UPC insurance policies are generally more expensive than traditional insurance policies. This is because they offer more comprehensive coverage and customization options. However, the cost of UPC insurance can vary depending on several factors, including:

- The specific coverages included in the policy

- The location of the insured property

- The value of the insured property

- The insured’s risk profile

In some cases, UPC insurance may be more cost-effective than traditional insurance, particularly for high-value properties or properties located in areas with high risk.

Pros and Cons

UPC Insurance

- Pros:

- Greater customization and flexibility

- More comprehensive coverage

- Potential for lower premiums in some cases

- Access to specialized services

- Cons:

- Higher premiums than traditional insurance

- More complex policy structure

- May require more effort to understand and manage

Traditional Insurance

- Pros:

- Lower premiums than UPC insurance

- Simpler policy structure

- Widely available

- Cons:

- Less customization and flexibility

- Limited coverage options

- May not be sufficient for high-value properties or properties with unique risks

Role of Technology in Universal Insurance

The insurance industry, like many others, is undergoing a rapid transformation driven by technological advancements. Universal insurance, with its flexible and comprehensive approach, is particularly well-suited to leverage these technologies to enhance customer experience, streamline operations, and improve risk assessment.

Digital Platforms and Online Tools

Digital platforms and online tools are revolutionizing the way customers interact with insurance providers. They offer convenience, transparency, and personalized experiences.

- Online Quoting and Policy Management: Customers can now obtain quotes, purchase policies, and manage their coverage online, eliminating the need for traditional paper-based processes. This allows for 24/7 access and reduces administrative burden for both customers and insurers.

- Personalized Recommendations: Utilizing data analytics, insurance companies can offer tailored policy recommendations based on individual customer needs and risk profiles. This ensures that customers are paying for the coverage they actually need, optimizing premiums and enhancing customer satisfaction.

- Digital Claims Reporting and Tracking: Digital platforms allow customers to report claims online or through mobile apps, providing real-time updates on claim status. This streamlined process significantly reduces processing time and enhances transparency for customers.

Innovative Technologies in Claims Processing and Risk Assessment

Emerging technologies are transforming the way insurance companies handle claims and assess risks. These advancements are improving efficiency, accuracy, and customer satisfaction.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms are being used to automate claims processing, detect fraud, and assess risk profiles. For example, AI-powered chatbots can handle routine inquiries and provide instant responses, while ML algorithms can analyze vast datasets to identify patterns and predict potential claims. This not only reduces processing time but also improves accuracy and efficiency.

- Internet of Things (IoT): IoT devices are collecting data on a variety of factors that can influence risk, such as driving behavior, home security, and health conditions. This data can be used to personalize insurance policies, offer discounts for safe driving, and monitor potential risks in real-time. For instance, smart home devices can detect potential hazards and trigger preventive measures, reducing the likelihood of claims.

- Blockchain Technology: Blockchain technology can enhance transparency and security in the insurance industry. It can be used to create an immutable record of transactions, improving the efficiency of claims processing and reducing fraud. Additionally, blockchain can facilitate peer-to-peer insurance models, allowing individuals to share risk and premiums directly, potentially leading to lower costs.

Future Trends and Innovations

The landscape of property and casualty insurance is undergoing a rapid transformation driven by technological advancements, evolving customer expectations, and changing regulatory environments. Universal insurance, with its flexible and customizable nature, is poised to play a pivotal role in shaping the future of this industry.

Impact of Emerging Technologies

The integration of cutting-edge technologies is fundamentally reshaping the way universal insurance operates.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are revolutionizing underwriting, risk assessment, and claims processing. By analyzing vast datasets, these technologies enable insurers to identify patterns, predict risks more accurately, and automate tasks, ultimately leading to faster and more efficient service delivery.

- Internet of Things (IoT): The proliferation of connected devices offers insurers unprecedented insights into policyholders’ behaviors and environments. By collecting real-time data from smart home devices, vehicles, and wearable sensors, insurers can offer personalized risk assessments, preventative measures, and dynamic pricing models. For example, a connected car can provide real-time data on driving habits, allowing insurers to offer discounts for safe driving behavior.

- Blockchain Technology: Blockchain’s decentralized and secure nature offers a promising solution for streamlining insurance processes. From policy management and claims processing to fraud detection, blockchain can enhance transparency, efficiency, and trust in the insurance ecosystem.

Regulatory Changes and Their Influence

Regulatory changes are playing a significant role in driving innovation in the universal insurance sector.

- Open Insurance: Open insurance initiatives are promoting data sharing and collaboration between insurers and third-party providers. This enables insurers to offer more personalized and customized insurance products, leveraging data from various sources to better understand customer needs.

- InsurTech Regulations: Regulations aimed at fostering innovation in the insurance technology (InsurTech) space are encouraging the development of new business models and disruptive technologies. This creates a fertile ground for universal insurance providers to experiment with innovative solutions and cater to the evolving demands of the market.

- Cybersecurity and Data Privacy: Increasing cybersecurity threats and growing concerns about data privacy are prompting insurers to invest in robust security measures and data protection strategies. This focus on security is essential for maintaining customer trust and safeguarding sensitive information in the digital age.

Key Areas for Future Advancements

Universal insurance is expected to witness significant advancements in several key areas:

- Personalized Insurance: Universal insurance is uniquely positioned to offer highly personalized insurance products tailored to individual needs and risk profiles. This is achieved by leveraging data analytics, AI, and customer insights to create customized coverage options that cater to specific requirements.

- On-Demand Coverage: The rise of the gig economy and the increasing demand for flexible insurance solutions are driving the development of on-demand insurance models. Universal insurance providers can offer temporary or short-term coverage for specific activities or events, providing greater flexibility and affordability.

- Predictive Analytics and Risk Management: Advancements in predictive analytics enable insurers to anticipate and mitigate risks more effectively. By analyzing historical data and real-time information, universal insurance providers can identify potential hazards and proactively implement preventive measures to minimize losses.

- Enhanced Customer Experience: Universal insurance is poised to deliver a seamless and personalized customer experience through digital channels, AI-powered chatbots, and mobile-first platforms. These innovations aim to simplify the insurance journey, provide instant access to information, and offer responsive customer support.

Real-World Examples and Case Studies

Universal property and casualty insurance, with its customizable coverage and flexible structure, has proven its value in diverse real-world scenarios. Here are examples showcasing its effectiveness in addressing specific customer needs and challenges.

Universal Insurance for Small Businesses

Universal insurance has been instrumental in providing comprehensive protection for small businesses facing unique risks.

“Universal insurance has been a game-changer for my small bakery. It allows me to tailor coverage to my specific needs, including equipment breakdown, product liability, and even business interruption due to unforeseen events. The flexibility and customization have been invaluable.” – Sarah, Owner of “Sweet Treats Bakery”

A case study of a small tech startup illustrates the benefits. The company, initially operating from a co-working space, required insurance that could adapt to its evolving needs. Universal insurance provided coverage for equipment, data breaches, and intellectual property, allowing the startup to focus on growth without worrying about unforeseen risks.

Universal Insurance for High-Net-Worth Individuals

Universal insurance caters to the complex needs of high-net-worth individuals, providing comprehensive protection for their assets and liabilities.

“As a successful entrepreneur, my insurance needs are multifaceted. Universal insurance has allowed me to combine coverage for my home, valuable art collection, and even my private jet under one policy. The personalized approach and dedicated support team have given me peace of mind.” – John, Founder of a Technology Company

A case study involving a wealthy family illustrates how universal insurance can address complex needs. The family, with a diverse portfolio of assets, required protection for their properties, investments, and personal liabilities. Universal insurance provided a customized solution, encompassing liability coverage for their art collection, cyber security protection for their investments, and comprehensive coverage for their luxury yacht.

Universal Insurance for Catastrophe Risk

Universal insurance offers valuable solutions for managing catastrophic risks, providing coverage for events like natural disasters and pandemics.

“Living in a hurricane-prone region, we were concerned about traditional insurance limitations. Universal insurance provided comprehensive coverage for our home, including flood and wind damage, giving us peace of mind during hurricane season.” – Michael, Homeowner in Florida

A case study of a coastal community demonstrates how universal insurance addressed the challenge of hurricane risk. The community, vulnerable to hurricane damage, struggled to find traditional insurance that adequately covered their needs. Universal insurance provided a customized solution, including coverage for flood damage, windstorm damage, and business interruption, mitigating the financial impact of potential hurricanes.

Considerations for Choosing Universal Insurance

Universal property and casualty insurance offers a comprehensive approach to risk management, providing a single policy for various types of coverage. However, deciding if it’s the right fit for your specific needs requires careful consideration of several factors. This section will delve into the key aspects to evaluate before making a decision.

Factors to Consider

The suitability of universal insurance hinges on a careful assessment of individual needs and circumstances. Here are some key factors to consider:

| Factor | Description |

|---|---|

| Coverage Needs | Universal insurance typically offers a broad range of coverage options, including property, liability, and personal injury. Assess your specific needs and ensure the policy provides adequate protection for your assets and liabilities. |

| Risk Profile | Consider your overall risk tolerance and the likelihood of potential claims. If you have a high-risk profile, universal insurance may be a suitable option to manage potential losses. |

| Budget and Affordability | Universal insurance premiums can vary depending on factors such as coverage levels, deductibles, and risk factors. Ensure the premiums are within your budget and align with your financial goals. |

| Customer Service and Claims Handling | Evaluate the insurer’s reputation for customer service and claims handling. Research their track record in resolving claims promptly and fairly. |

| Policy Flexibility and Customization | Universal insurance often allows for customization to meet individual needs. Assess the flexibility of the policy and its ability to adapt to changing circumstances. |

| Technology and Innovation | Consider the insurer’s adoption of technology and its impact on customer experience, claims processing, and overall service delivery. |

Pros and Cons of Universal Insurance

While universal insurance offers a comprehensive approach, it’s essential to weigh the advantages and disadvantages against your specific needs.

Pros

- Comprehensive Coverage: Universal insurance provides a single policy covering various risks, simplifying risk management and potentially reducing the need for multiple policies.

- Potential Cost Savings: By bundling multiple coverages, universal insurance may offer cost savings compared to purchasing individual policies.

- Customization and Flexibility: Many universal insurance policies allow for customization, enabling you to tailor coverage to your specific needs.

- Convenience: Managing a single policy simplifies administration and communication with the insurer.

Cons

- Higher Premiums: Universal insurance may have higher premiums compared to individual policies, especially if you only need a few types of coverage.

- Complexity: Understanding the nuances of a comprehensive policy can be challenging, requiring careful review and consultation with an insurance professional.

- Limited Coverage Options: While universal insurance offers a wide range of coverage, it may not include all specialized or niche options available with individual policies.

Questions to Ask Before Making a Decision

Before committing to universal insurance, consider asking yourself the following questions:

- What are my specific coverage needs and risk exposures?

- What is my budget for insurance premiums, and how does universal insurance compare to other options?

- What is the insurer’s reputation for customer service and claims handling?

- What level of customization and flexibility does the policy offer?

- How does the insurer leverage technology to enhance the customer experience?

- Are there any specific coverage limitations or exclusions in the policy?

Ultimate Conclusion

Universal property & casualty insurance represents a paradigm shift in the way we approach risk management, empowering individuals and businesses with unprecedented control and flexibility. As technology continues to reshape the insurance industry, universal property & casualty insurance is poised to become the dominant force, offering a personalized and cost-effective solution for safeguarding against life’s uncertainties. With its ability to adapt to evolving risk profiles and leverage the power of data analytics, universal property & casualty insurance is ushering in a new era of risk management, where individuals and businesses can confidently navigate the complexities of modern life.