Navigating the world of life insurance can feel like traversing a labyrinth of complex terms and hefty premiums. But what if there was a tool to demystify this process and empower you to make informed decisions? Enter the life insurance calculator, a digital wizard that can shed light on the cost of coverage, allowing you to tailor a policy that aligns with your budget and needs.

Life insurance calculators are essentially online tools that help individuals estimate the cost of life insurance based on their specific circumstances. These calculators take into account factors such as age, health, lifestyle, and desired coverage amount, providing a personalized glimpse into the potential premiums they might face.

Understanding Life Insurance Calculators

Life insurance calculators are powerful tools that can help you determine how much coverage you need and estimate the monthly premiums you might pay. These calculators use various factors to provide personalized estimates, enabling you to make informed decisions about your life insurance needs.

Types of Life Insurance Calculators

Life insurance calculators come in different varieties, catering to specific needs and types of coverage. The most common types include:

- Term Life Calculators: These calculators help determine the amount of term life insurance you need based on your financial obligations and the duration of coverage you require. Term life insurance provides coverage for a specific period, typically 10 to 30 years.

- Whole Life Calculators: Whole life insurance calculators help estimate the premiums for permanent coverage that lasts your entire lifetime. These calculators consider factors such as your age, health, and the amount of coverage you need.

- Universal Life Calculators: These calculators help determine the premiums and potential cash value growth for universal life insurance policies. Universal life insurance offers flexible premiums and death benefits, allowing you to adjust coverage based on your changing needs.

Factors Influencing Life Insurance Costs

Several factors play a crucial role in determining your life insurance premiums. Understanding these factors can help you make informed choices about your coverage.

- Age: Younger individuals generally pay lower premiums than older individuals. This is because younger individuals have a lower risk of dying prematurely.

- Health: Your health status significantly impacts your premiums. Individuals with pre-existing conditions or risky lifestyle choices typically pay higher premiums.

- Lifestyle: Your lifestyle habits, such as smoking or engaging in dangerous hobbies, can influence your premiums. Insurers consider these factors as they contribute to your risk profile.

- Coverage Amount: The amount of coverage you choose directly impacts your premiums. Higher coverage amounts typically result in higher premiums.

- Policy Term: The length of your coverage, known as the policy term, also influences your premiums. Longer terms generally lead to higher premiums.

- Insurer: Different insurers have different pricing structures and underwriting guidelines. It’s essential to compare quotes from multiple insurers to find the best rates.

Factors Influencing Life Insurance Costs

Life insurance premiums are influenced by a variety of factors, each contributing to the overall cost of coverage. Understanding these factors can help you make informed decisions about your life insurance needs and find the most affordable policy for your situation.

Age

Age is a significant factor in determining life insurance premiums. Younger individuals generally pay lower premiums than older individuals. This is because younger people have a longer life expectancy, making them less likely to file a claim. As you age, your life expectancy decreases, increasing the likelihood of a claim and, consequently, the premium.

Health

Your health status plays a crucial role in determining your life insurance premiums. Individuals with excellent health typically pay lower premiums compared to those with pre-existing health conditions. Life insurance companies assess your health through medical exams, questionnaires, and a review of your medical history.

Lifestyle

Lifestyle choices can also impact your life insurance premiums. For example, individuals who engage in risky activities, such as smoking, excessive alcohol consumption, or dangerous hobbies, may face higher premiums. This is because these activities can increase the likelihood of premature death.

Coverage Amount

The amount of coverage you choose will also affect your premium. Higher coverage amounts generally mean higher premiums. This is because the insurer is assuming greater financial responsibility in the event of your death.

Type of Policy

Different types of life insurance policies have varying costs. For example, term life insurance policies are typically more affordable than permanent life insurance policies. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifetime coverage.

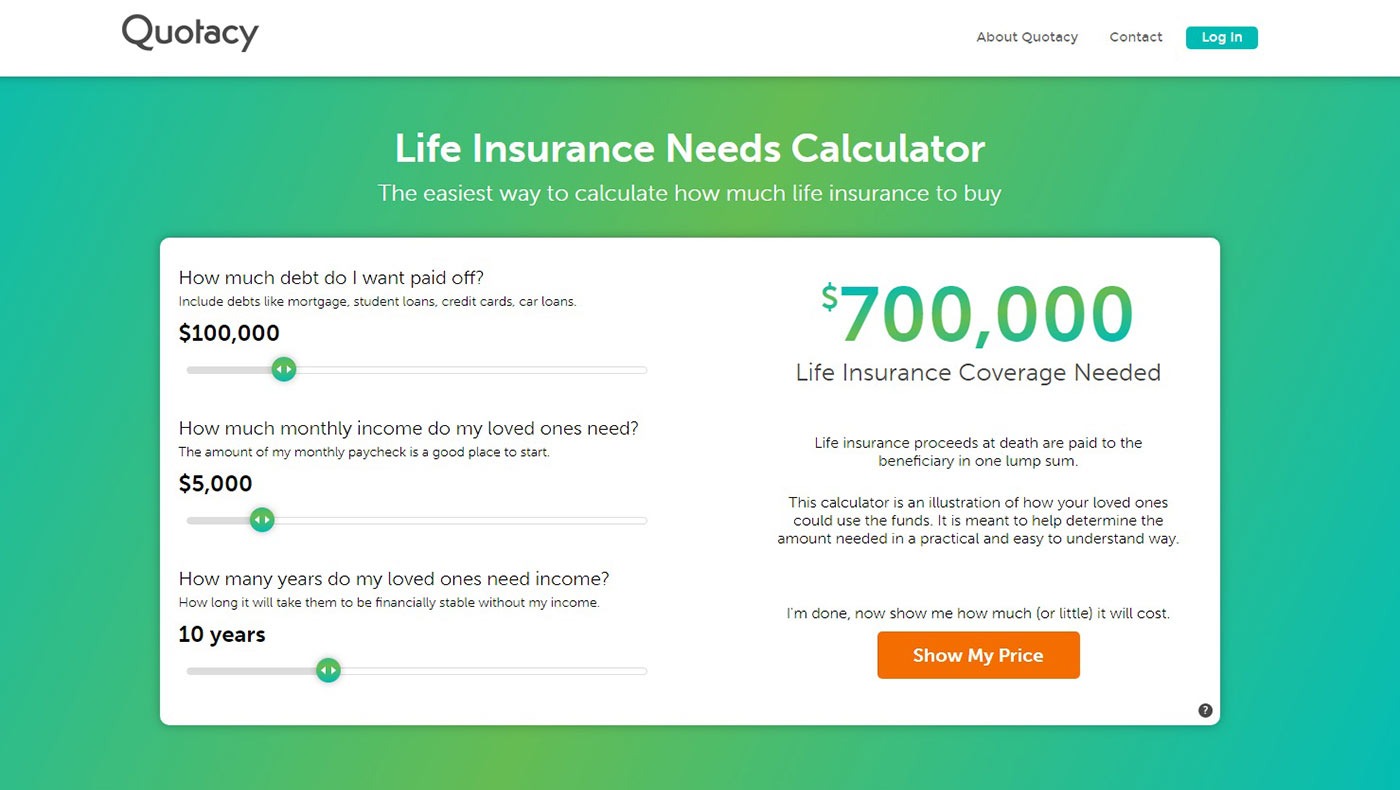

Using a Life Insurance Calculator

Life insurance calculators are powerful tools that can help you determine the appropriate amount of coverage you need. They simplify the process of calculating your life insurance needs by considering various factors, including your income, dependents, debts, and financial goals.

Understanding the Process

Life insurance calculators work by gathering your personal information and using it to calculate an estimated amount of coverage. The process typically involves a series of questions about your financial situation, including:

- Your current income

- Your spouse’s income (if applicable)

- Your outstanding debts (mortgage, loans, etc.)

- Your dependents (children, spouse, etc.)

- Your financial goals (college education, retirement, etc.)

Based on your responses, the calculator will estimate the amount of money your family would need to cover your financial obligations and maintain their current lifestyle in your absence.

Inputting Personal Information and Coverage Details

To use a life insurance calculator effectively, you’ll need to provide accurate information. The calculator will typically ask for details such as:

- Your age

- Your health status

- Your desired coverage amount

- Your preferred policy type (term life, whole life, etc.)

It’s crucial to be honest and thorough when providing this information, as it will directly impact the calculator’s results.

Interpreting the Results and Making Informed Decisions

Once you’ve entered your information, the calculator will provide an estimated life insurance coverage amount. This figure represents the amount of money your family would receive upon your death. The results can be a valuable starting point for your life insurance planning. However, it’s essential to remember that these are just estimates.

The results of a life insurance calculator should not be considered a definitive solution. It’s always advisable to consult with a financial advisor or insurance agent to get personalized guidance.

You should consider factors like your individual circumstances, risk tolerance, and financial goals when interpreting the calculator’s results. It’s also important to compare quotes from multiple insurance providers to find the best rates and coverage options for your needs.

Benefits of Using a Life Insurance Calculator

A life insurance calculator is a valuable tool that can help you determine the appropriate amount of life insurance coverage and estimate your monthly premiums. By using this calculator, you can gain a clear understanding of your insurance needs and make informed financial decisions.

Estimating Life Insurance Costs

Using a life insurance calculator allows you to get a personalized estimate of your monthly premiums based on your individual circumstances. This can help you budget for your life insurance needs and make informed financial decisions. By inputting your age, health, desired coverage amount, and other relevant factors, the calculator provides an estimated cost, giving you a clear idea of what you can expect to pay.

Making Informed Financial Decisions

Life insurance calculators provide a comprehensive overview of your financial situation and highlight the importance of life insurance. By using the calculator, you can assess your current financial obligations and determine the amount of coverage you need to protect your loved ones in the event of your death. The calculator helps you understand the financial impact of your passing and makes it easier to make informed decisions about your life insurance needs.

Comparing Life Insurance Providers

One of the key benefits of using a life insurance calculator is its ability to compare different insurance providers. By inputting your details into multiple calculators from different insurance companies, you can easily compare their premiums and coverage options. This helps you identify the most competitive rates and choose the insurance provider that best suits your needs and budget.

Key Considerations When Choosing Life Insurance

Selecting the right life insurance policy is a crucial decision that requires careful consideration. Numerous factors come into play, including your individual circumstances, financial goals, and risk tolerance. To ensure you choose a policy that aligns with your needs and provides adequate coverage, it’s essential to understand the key considerations involved.

Factors Influencing Life Insurance Policy Selection

Choosing the right life insurance policy involves considering various factors that can significantly impact your coverage and premiums. These factors are interconnected and should be carefully weighed to determine the best fit for your individual needs.

| Factor | Description | Importance | Example |

|---|---|---|---|

| Coverage Amount | The amount of financial protection your beneficiaries will receive upon your death. | Essential to ensure sufficient funds to cover financial obligations and maintain the desired lifestyle for your dependents. | If you have a mortgage, outstanding debts, or dependents relying on your income, a higher coverage amount is generally recommended. |

| Premium Cost | The monthly or annual payment you make for the life insurance policy. | Influenced by factors such as age, health, coverage amount, and policy type. | Younger individuals with good health typically pay lower premiums compared to older individuals with health issues. |

| Policy Term | The duration for which the life insurance policy remains in effect. | Determines the length of time your beneficiaries are covered. | Term life insurance policies typically have fixed terms, such as 10, 20, or 30 years, while permanent life insurance policies provide lifelong coverage. |

| Benefits | The specific features and advantages offered by the life insurance policy. | Can include options such as cash value accumulation, loan provisions, and death benefits. | Some policies offer additional benefits like accidental death coverage or critical illness coverage. |

Exploring Different Life Insurance Options

Life insurance is a crucial financial tool that can provide financial security for your loved ones in the event of your untimely demise. When it comes to choosing the right life insurance policy, understanding the different types available is essential. Two of the most common types of life insurance are term life insurance and whole life insurance. Each type offers distinct features, benefits, and drawbacks, making it crucial to carefully consider your individual needs and financial situation before making a decision.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It is considered a more affordable option compared to whole life insurance.

- Features: Term life insurance offers a death benefit, which is paid out to your beneficiaries if you pass away during the policy’s term. It is typically a pure protection policy, meaning it does not accumulate cash value.

- Benefits:

- Affordability: Term life insurance is generally the most affordable type of life insurance, making it an attractive option for individuals on a budget.

- Simplicity: Term life insurance policies are relatively simple to understand and manage.

- Flexibility: You can choose the term length that best suits your needs, ensuring coverage for a specific period.

- Drawbacks:

- Temporary Coverage: Coverage is only valid for the chosen term, and you will need to renew or purchase a new policy once the term expires.

- No Cash Value: Term life insurance does not accumulate cash value, meaning you cannot borrow against it or withdraw funds.

Example: A young couple with a mortgage and two young children might opt for a 30-year term life insurance policy to ensure their family’s financial security in the event of the breadwinner’s death.

Whole Life Insurance

Whole life insurance provides permanent coverage for your entire life, as long as you continue to pay the premiums. Unlike term life insurance, whole life insurance accumulates cash value, which grows over time.

- Features: Whole life insurance offers a death benefit, and it also builds cash value, which can be accessed through loans or withdrawals. The premium payments are typically higher than term life insurance premiums due to the cash value component.

- Benefits:

- Permanent Coverage: Coverage lasts for your entire life, as long as you continue to pay the premiums.

- Cash Value Accumulation: Whole life insurance policies accumulate cash value, which can be used for various financial purposes, such as retirement savings, college funding, or emergency expenses.

- Loan Options: You can borrow against the cash value of your policy at a fixed interest rate.

- Drawbacks:

- Higher Premiums: Whole life insurance premiums are typically higher than term life insurance premiums due to the cash value component.

- Complexity: Whole life insurance policies can be more complex than term life insurance policies, requiring careful consideration of investment strategies and potential tax implications.

Example: A successful entrepreneur with a large estate might choose whole life insurance to provide a death benefit for their heirs and accumulate cash value for estate planning purposes.

Life Insurance and Financial Planning

Life insurance plays a crucial role in comprehensive financial planning, ensuring that loved ones are financially secure in the event of your passing. It provides a financial safety net, protecting your family from the burden of outstanding debts, funeral expenses, and ongoing living costs.

Integrating Life Insurance into Financial Strategies

Integrating life insurance into your financial strategy is essential for protecting your loved ones’ financial well-being. It provides a safety net that can help them navigate the unexpected challenges that arise when a family member passes away.

- Determine Coverage Needs: Calculate the amount of coverage required based on your family’s needs, including outstanding debts, funeral expenses, and ongoing living costs. Consider factors such as mortgage payments, children’s education, and potential income replacement.

- Choose the Right Policy: Select a life insurance policy that aligns with your financial goals and risk tolerance. Explore different types of policies, including term life, whole life, and universal life, to find the one that best suits your needs.

- Review Coverage Regularly: Life circumstances change over time. It’s crucial to review your life insurance coverage periodically to ensure it remains adequate to meet your evolving needs. Factors such as changes in income, family size, and debt levels can influence your coverage requirements.

- Consider Beneficiary Designation: Clearly designate beneficiaries for your life insurance policy. Ensure that the beneficiaries are informed of their rights and responsibilities.

- Coordinate with Other Financial Planning Tools: Integrate life insurance with other financial planning tools, such as wills, trusts, and estate planning documents. This ensures a coordinated approach to managing your assets and protecting your family’s interests.

Seeking Professional Advice

While online life insurance calculators can be helpful in providing initial estimates, seeking professional advice from a financial advisor is crucial for making informed decisions about your life insurance needs. A financial advisor can offer personalized guidance based on your unique circumstances and financial goals.

Benefits of Consulting a Financial Advisor

Consulting a financial advisor can provide numerous benefits when it comes to life insurance planning. They can help you:

- Determine the Right Coverage Amount: A financial advisor can assess your income, expenses, debts, and dependents to determine the appropriate amount of life insurance coverage you need. They will consider factors such as your family’s financial obligations, potential future expenses, and your desired legacy.

- Choose the Right Type of Policy: There are various types of life insurance policies available, each with its own features, benefits, and costs. A financial advisor can help you understand the different options and choose the policy that best suits your individual needs and financial situation.

- Evaluate Different Insurance Providers: The life insurance market is competitive, with numerous providers offering various policies and premiums. A financial advisor can help you compare different providers and find the best value for your money.

- Develop a Comprehensive Financial Plan: Life insurance is just one component of a comprehensive financial plan. A financial advisor can integrate your life insurance needs into your overall financial strategy, ensuring it aligns with your long-term goals and objectives.

“A financial advisor can provide valuable insights and guidance, ensuring you make informed decisions about your life insurance coverage.”

Conclusion

Life insurance calculators are powerful tools that empower individuals to make informed decisions about their coverage needs. By understanding the factors influencing life insurance costs, utilizing a calculator, and considering different options, you can navigate the complex world of life insurance with greater clarity.

Key Takeaways

Life insurance calculators provide valuable insights into the cost of life insurance, enabling you to:

* Estimate premiums based on personal factors: Age, health, coverage amount, and policy type influence premiums. Calculators help assess these factors’ impact on your costs.

* Compare different policy options: Calculators allow you to explore various policy types, such as term life insurance, whole life insurance, and universal life insurance, to find the best fit for your needs and budget.

* Identify potential savings opportunities: Understanding the factors that impact premiums can help you make informed choices to potentially lower your costs.

Life insurance calculators are a valuable tool for gaining a better understanding of life insurance costs and options.

The Importance of Professional Guidance

While life insurance calculators are helpful, it’s essential to remember that they are just tools. Seeking professional guidance from a qualified insurance agent or financial advisor is crucial for making informed decisions about your life insurance needs. They can provide personalized advice, considering your specific circumstances, goals, and financial situation.

Professional guidance is essential for navigating the complex world of life insurance and making informed decisions that align with your individual needs.

Final Review

Armed with the knowledge provided by a life insurance calculator, you can confidently navigate the world of insurance, securing the financial protection your loved ones deserve. Remember, a calculator is just one piece of the puzzle. Consulting with a financial advisor can provide personalized guidance and ensure your policy meets your unique circumstances and financial goals.